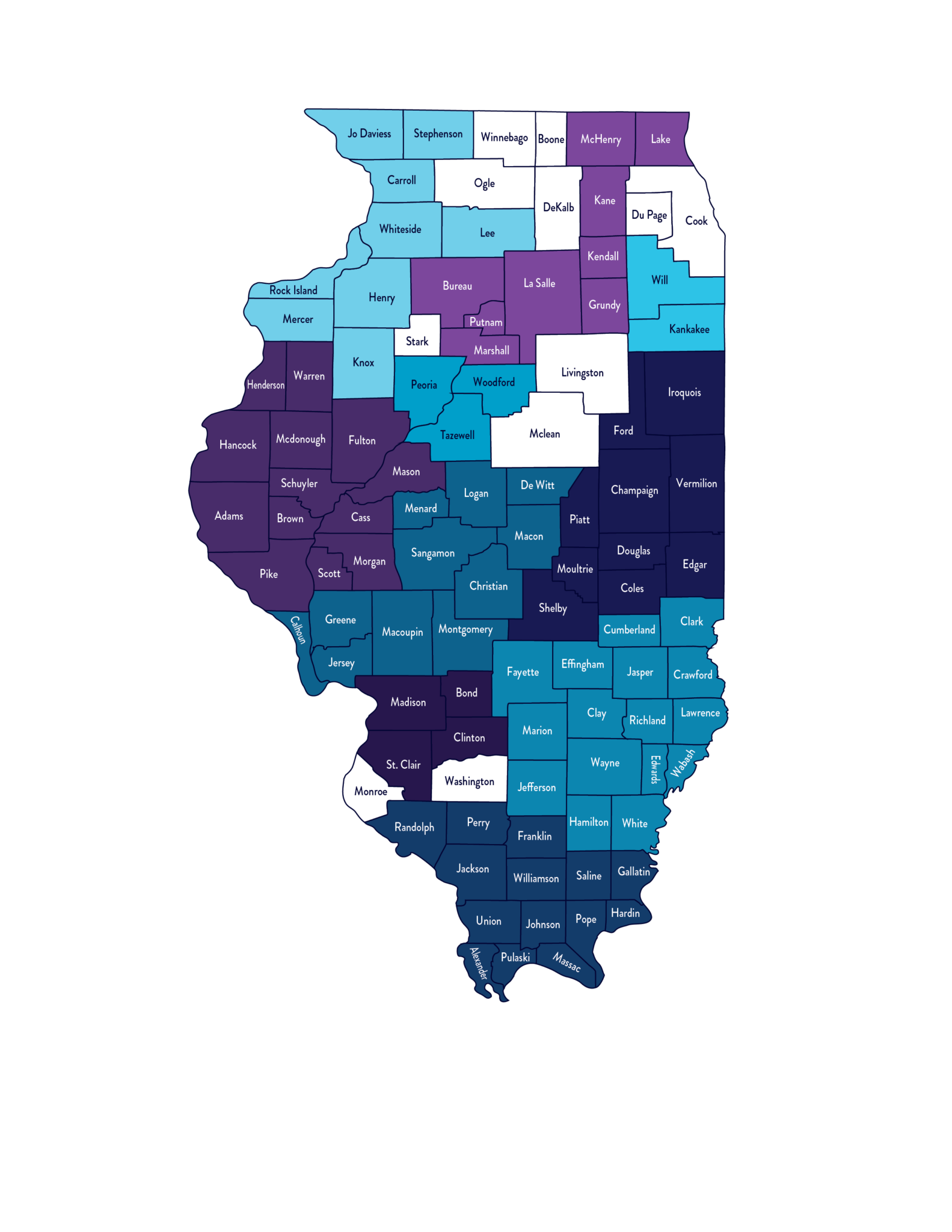

Illinois Enterprise Zone Changes 2022

Illinois Enterprise Zone Changes for 2022. Please take note of the following changes to take effect on January 1st, 2022. P.A. 102-0108 clarifies that the Illinois Enterprise Zone Act authorizes a total of 97 enterprise zones to be in existence at any given time under the Act, other than those authorized.