Lowest Cost Tax-Exempt Financing

Illinois Regional Development Authorities (IL-RDAs)

grow Illinois

History

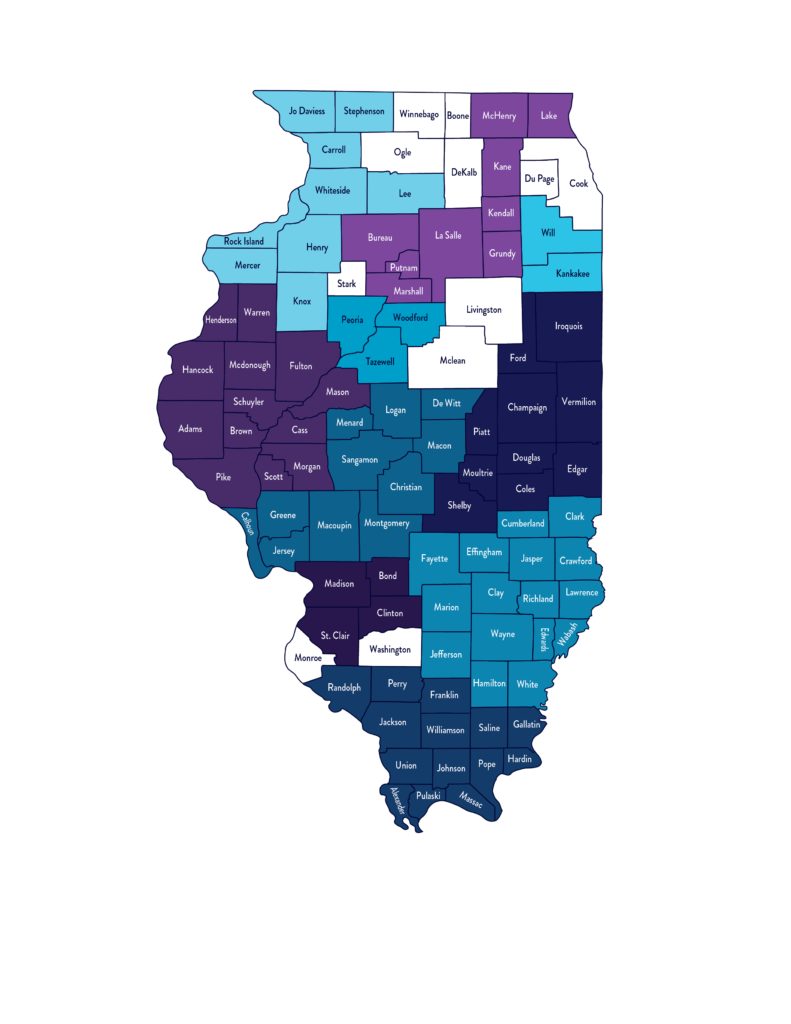

One of the best-known secrets to some involved in economic development in Illinois are the ten Illinois Regional Development Authorities (RDAs) created by Illinois law as “Special District” units of government to promote economic development by offering low-cost financing to eligible projects. These ten RDAs cover 91 of the 102 counties in Illinois and were created over a period from 1985 to 2006.

the IL-RDA Advantage

Regional Territories Include:

Northeastern Illinois– Upper Illinois River Valley Development Authority (9 counties) and Will Kankakee Regional Development Authority (2 counties);

Northwestern Illinois– Quad Cities Regional Economic Development Authority (9 counties);

North Central Illinois– Tri-County River Valley Development Authority (3 counties);

Western Illinois– Western Illinois Economic Development Authority (13 counties);

Eastern Illinois– Eastern Illinois Economic Development Authority (10 counties);

Central Illinois– Central Illinois Economic Development Authority (11 counties);

Southwestern Illinois– Southwestern Illinois Economic Development Authority (4 counties);

Southern Illinois– Southern Illinois Economic Development Authority (14 counties) and Southeastern Illinois Economic Development Authority (16 counties).

Innovative Economic Development for Illinois' Communities

IL-RDAs

plan of action

Expanded Summary

Each of the RDAs is governed by a local Board of Directors generally consisting of one Board member from each county, appointed by the County Board, and appointments by the Governor. Some include representatives from related State agencies.

The RDAs are authorized to issue tax-exempt bonds for eligible projects such as small manufacturing, affordable housing, non-profit entities, educational facilities, local government infrastructure, and certain environmental projects. Types of bonds issued include Manufacturing Industrial Revenue Bonds; Affordable, Senior and Assisted Living Multi-family Housing Revenue Bonds; 501c3 Not-for-Profit Revenue Bonds for entities including Hospitals, Medical Facilities, Private University, and Charter Schools, YMCA’s, Community Centers, and Goodwill facilities; Education Bonds for public school districts, Local Government Bonds, Dock and Wharf Bonds along Waterways and Port Districts, and Solid Waste Reduction Bonds to convert waste materials to commercially viable products.

The RDAs issue bonds that are purchased by either an investment bank or securities firm (public placement), or by a local financial institution (private placement). The bond purchaser then lends the proceeds to a borrower to finance the projects described above. The bonds issued by an RDA are “double tax-exempt”, meaning that the purchaser does not pay state or federal taxes on the interest income. This savings is then passed on to the borrower in the form of a lower interest rate.

Bond financing for projects funded from an RDA bond is usually the lowest cost of borrowing with interest rates reduced in the range of 2-3% below conventional financing. The RDA acts as a conduit financier and does not determine credit worthiness, does not take on risk for repayment, and does not determine the actual interest rate. Those functions are performed by the purchaser of the bond. The RDA uses its governmental powers to issue double tax-exempt bonds to provide the lower-cost capital to finance the project.

State tax exemption on bonds issued by an Illinois RDA is a unique power provided by law to the RDAs. Bonds issued by other governmental issuers require the purchaser to pay state taxes on the bond income. This unique power, double tax exemption, provides additional savings to a borrower whose project is funded by an RDA bond.

Because the RDAs are locally governed and do not rely on government funding, they have been described as a “nimble issuer”, non-bureaucratic, and flexible in their operating procedures. The RDAs are self-sufficient and don’t rely on state or local government funding. The RDAs fund their operations from fees earned on bonds issued to finance projects. These fees are significantly less than the cost savings achieved by the borrower.

Five of the RDAs have their own enterprise zone and can provide traditional enterprise zone benefits for project site locations within the RDA but are not otherwise included in one of the 97 enterprise zones across the State. The RDA enterprise zones seek to supplement the local enterprise zones in territories not covered by other enterprise zones.

Illinois RDAs have had a significant economic impact to incent investment, job creation, and retention, and economic development within their regions and for the State as a whole. Collectively the RDAs have facilitated $1,120,046,919 in lower-cost bond-financed investment creating and retaining 9057 jobs involving 100 separate projects. The RDAs with enterprise zones have incented an investment of $1,789,495,075, creating and retaining 13,238 jobs in 55 projects.

For more information on the economic development opportunities provided by the Illinois RDAs, please visit their websites and make inquiries as needed and directed within the websites:

Southern Illinois Economic Development Authority- www.sidail.com

Southeastern Illinois Economic Development Authority- www.siedail.com

Southwestern Illinois Economic Development Authority- www.swida.com

Central Illinois Economic Development Authority- www.cieda.co

Eastern Illinois Economic Development Authority- www.eieda.com

Western Illinois Economic Development Authority- www.wieda.com

Tri-County River Valley Development Authority- www.trvda.com

Quad Cities Regional Economic Development Authority- www.qcreda.com

Upper Illinois River Valley Development Authority- www.uirvda.com

Will Kankakee Regional Development Authority- www.wrkda.com

Share this Article!

Head Office

- PO Box Springfield

- 888-888-888

- 818-674-1177

- office@il-rda.com

Site Links

The Partners

- UIRVDA

- QCREDA

- WIEDA

- CIEDA

- TRVDA

.

- SIEDA

- WKRDA

- SIDA

- EIEDA